Some Known Facts About Pvm Accounting.

Table of ContentsExcitement About Pvm AccountingNot known Details About Pvm Accounting The smart Trick of Pvm Accounting That Nobody is Talking AboutThe 8-Minute Rule for Pvm Accounting5 Simple Techniques For Pvm AccountingThe Ultimate Guide To Pvm Accounting

Look after and handle the creation and authorization of all project-related invoicings to clients to promote excellent communication and prevent problems. Clean-up bookkeeping. Make certain that ideal reports and documentation are sent to and are updated with the IRS. Ensure that the accountancy procedure adheres to the regulation. Apply called for building accounting standards and treatments to the recording and reporting of construction task.Understand and maintain standard expense codes in the accounting system. Connect with different financing companies (i.e. Title Firm, Escrow Business) regarding the pay application process and requirements needed for repayment. Handle lien waiver disbursement and collection - https://www.openstreetmap.org/user/pvmaccount1ng. Screen and fix financial institution issues consisting of fee anomalies and inspect distinctions. Help with carrying out and maintaining internal financial controls and procedures.

The above statements are planned to explain the basic nature and degree of job being done by people assigned to this classification. They are not to be taken as an exhaustive listing of duties, duties, and abilities called for. Workers may be called for to do responsibilities beyond their typical duties periodically, as required.

5 Easy Facts About Pvm Accounting Explained

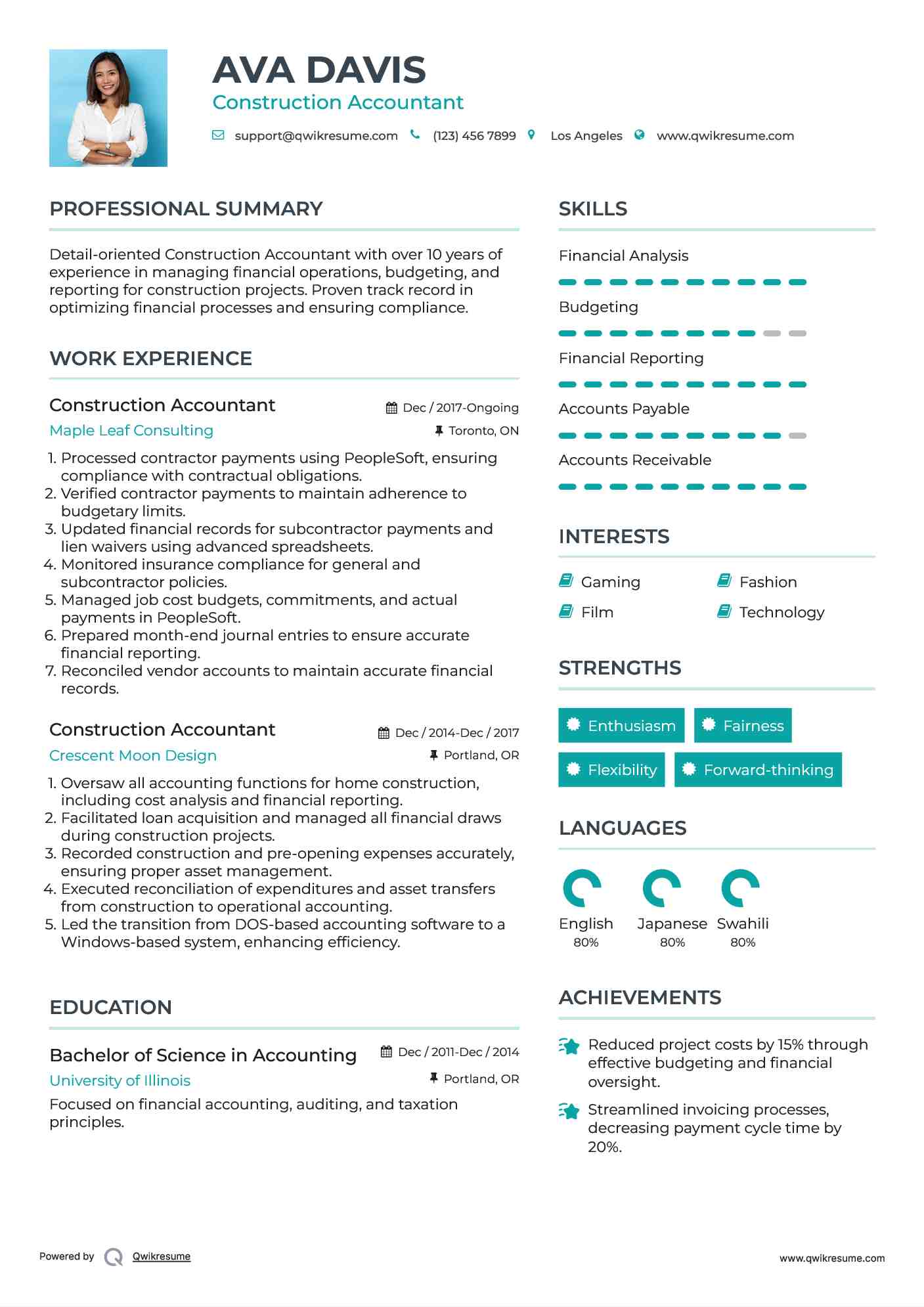

You will aid support the Accel team to guarantee delivery of successful on schedule, on budget, tasks. Accel is seeking a Construction Accounting professional for the Chicago Office. The Building Accounting professional does a variety of accounting, insurance conformity, and project management. Works both individually and within certain divisions to maintain financial records and make specific that all documents are maintained current.

Principal tasks consist of, yet are not limited to, taking care of all accounting features of the firm in a prompt and accurate manner and providing reports and routines to the business's CPA Firm in the preparation of all monetary declarations. Ensures that all audit treatments and features are taken care of properly. In charge of all monetary records, payroll, financial and day-to-day procedure of the audit feature.

Works with Project Managers to prepare and upload all month-to-month billings. Produces monthly Job Cost to Date records and functioning with PMs to integrate with Job Managers' budgets for each project.

What Does Pvm Accounting Do?

Proficiency in Sage 300 Construction and Real Estate (formerly Sage Timberline Workplace) and Procore construction monitoring software an and also. https://leonelcenteno.wixsite.com/pvmaccount1ng/post/unlocking-the-secrets-of-construction-accounting. Need to likewise excel in various other computer software systems for the prep work of reports, spreadsheets and various other audit evaluation that may be called for by monitoring. Clean-up bookkeeping. Should possess solid business skills and capacity to focus on

They are the economic custodians who guarantee that building and construction jobs stay on budget plan, abide by tax regulations, and preserve economic transparency. Building accountants are not just number crunchers; they are strategic partners in the building and construction process. Their main duty is to take care of the financial elements of building and construction projects, making sure that sources are assigned effectively and economic threats are minimized.

Some Known Details About Pvm Accounting

By keeping a tight hold on task financial resources, accounting professionals help protect against overspending and monetary setbacks. Budgeting is a keystone of effective building projects, and building accountants are crucial in this regard.

Construction accountants are well-versed in these guidelines and make certain that the task conforms with all tax requirements. To stand out in the function of a construction accounting professional, individuals need a strong educational structure in accountancy and financing.

In addition, qualifications such as Certified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Certified Construction Market Financial Expert (CCIFP) are extremely related to in the market. Building projects typically include tight due dates, changing regulations, and unexpected expenses.

The Greatest Guide To Pvm Accounting

Specialist certifications like CPA or CCIFP are likewise highly recommended to demonstrate competence in building bookkeeping. Ans: Building accountants create and keep track of budget plans, identifying cost-saving opportunities and making certain that the job stays within spending plan. They likewise track costs and projection monetary needs to avoid overspending. Ans: Yes, building and construction accounting professionals handle tax conformity for construction tasks.

Introduction to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction firms have to make difficult selections amongst numerous economic choices, like bidding process on one project over one more, choosing financing for materials or devices, or setting a project's earnings margin. In addition to that, construction is a notoriously volatile industry with a high failure rate, slow time to payment, and inconsistent capital.

Common manufacturerConstruction business Process-based. Manufacturing involves repeated procedures with conveniently identifiable prices. Project-based. Manufacturing requires different processes, materials, and devices with differing prices. Repaired area. Production or production occurs in a solitary (or numerous) controlled locations. Decentralized. Each job happens in a brand-new location with varying site problems and special difficulties.

Fascination About Pvm Accounting

Regular use of various specialized specialists and vendors affects performance and money circulation. Payment visit site shows up in complete or with normal settlements for the full agreement quantity. Some section of payment may be withheld until project completion even when the professional's work is completed.

Routine manufacturing and temporary contracts cause manageable money circulation cycles. Uneven. Retainage, slow-moving settlements, and high ahead of time prices result in long, irregular cash circulation cycles - Clean-up bookkeeping. While traditional suppliers have the benefit of controlled environments and maximized production processes, construction companies have to regularly adjust to every new project. Even somewhat repeatable tasks require alterations because of site conditions and various other elements.